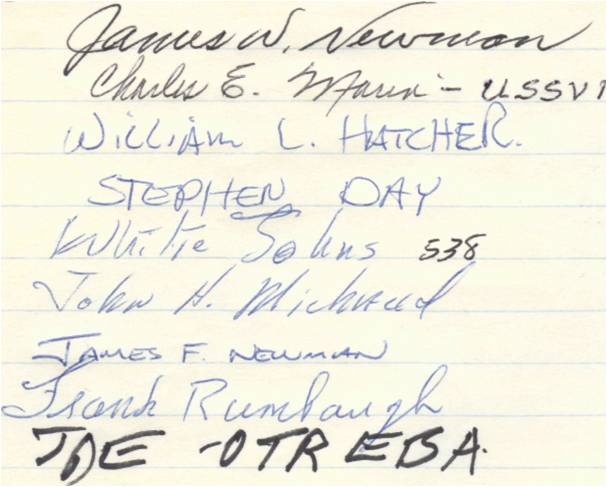

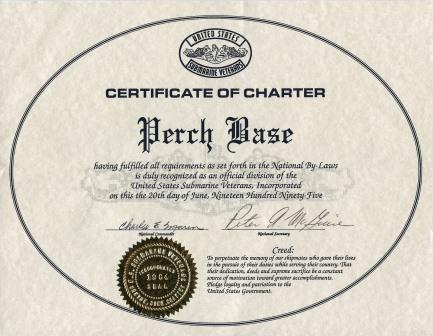

Perch Base USSVI started as a meeting on April 1, 1995 of nine submarine veterans on the patio of

Jim Newman's house. (Jim was the first Base Commander.) The Base was originally to be named "Phoenix Base," but in

the tradition of naming bases after Lost Boats, was ultimately named "Perch Base," in memory of the

USS Perch (SS-176) lost on March 3, 1942.

Click on any thumbnail for a larger picture.

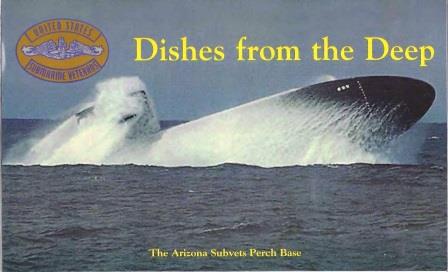

Perch Base published a 140 page Perch Base cookbook titled, "Dishes From the Deep," vintage 1996, as a

base fundraiser. Thanks to Layne Moss who provided a copy.

There are references to sales ($6 + $1 shipping) in the November and

December 1999 MidWatch newsletters.

There was also a motion passed at the 10 October 1999 Base meeting to advertise the cookbook in the

American Submariner.

The April 2000 Midwatch also noted that 5 copies were

donated to the USSVI Buffalo Base for a silent auction to replace the tiles in their Memorial Submarine,

the USS CROAKER (SS246).

The September 2000 MidWatch noted that seven (7)

of the dishes from the Dishes From the Deep Cookbook recipes were chosen by the Quail Ridge Press to appear

in their upcoming book, "Best of the Best from Arizona," including:

(1) by Maddie Braastad (Peanut Butter Pie,)

(2) by Muriel Grieves (Pork Chop Skillet Dinner and Self Filled Cupcakes,)

(3) by Frank Rumbaugh (Frito Pie,) and

(4) by Lee Cousin (Stuffed Mushrooms, Cheesy Potato Sticks and Broccoli Puff.)

Besides these winners, Perch Base also received the honor of having its cookbook listed in the "Contributing Cookbook"

category within the publication, with the following plug: Dishes From the Deep by Arizona Perch Base Submarine

Veterans. The Submarine Veterans of Arizona Perch Base have come up with a unique 140 page cookbook entitled

Dishes from the Deep. All of the recipes come directly from the submarine veterans or their wives who have been

preparing them for years (including the famous "SOS"). The majority of these recipes are quick and easy. We

believe that all those who purchase it will find it most interesting and delicious.

The MidWatch edition thanked all those ladies who worked so hard to make this book possible. Especially,

Gayle Loftus, Judy Patterson and Shannon Thomason.

Charitable Donation Information

The national organization of the United States Submarine Veterans Incorporated (USSVI) is incorporated

in the State of Connecticut and is recognized by the IRS as a 501(c)(19) veterans organization with an

IRS Determination Letter documenting the

Section 501(c)(19) status. This makes the USSVI a "TAX EXEMPT" organization. Thus, USSVI does not

have to pay taxes, BUT YOUR DONATIONS ARE NOT "TAX DEDUCTIBLE". Unfortunately, donations are only

deductible if at least 90% of the membership are members who have served during congressionally designated

periods of war. (Reference: IRS Publication 3386, Tax Guide for Veterans’

Organizations, page 37 (page 39 of 54 of the pdf file).) During 2017, our percentage of war veterans dropped below 90%.

The percentage of war veterans is periodically re-calculated and we may again qualify in the future. Also, there are

legal challenges underway to eliminate the percentage requirement. On the other hand, the standard deduction has

been raised so high that few people itemize their charitable deductions. In 2017, 180 million taxpayers used the

IRS Schedule A for itemizing tax deductions, but in 2018, only 13 million used the itemized form.

The latest USSVI IRS Form 990 Tax Return is available for public inspection via the

USSVI Home Page by selecting the "Documents"

button on the left column and then selecting the "Organization" button on the

left column of the next page.